American Resources Corporation Reports Fourth Quarter and Full Year 2019 Financial Results and Provides Business Outlook

ACCESS Newswire

01 Jun 2020, 18:07 GMT+10

- Company well-positioned to be a long-term supplier of raw material to the global infrastructure market while bringing a more efficient and modernized business model to the industry

- Strategic steps taken over the course of 2019 transformed Company into infrastructure company producing pure metallurgical carbon, while enhancing environmental, social and governance (ESG) profile

- Company poised to execute on multiple value driving milestones over the course of 2020

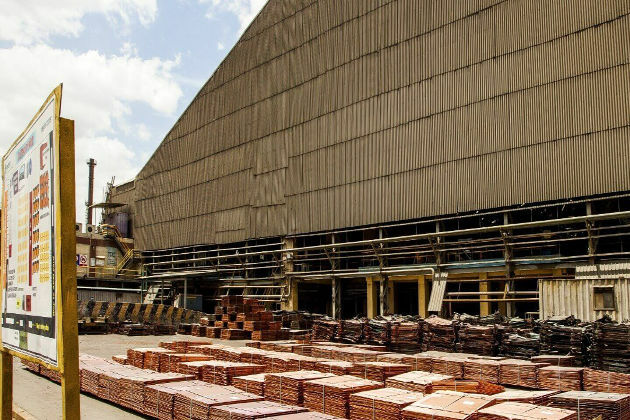

FISHERS, IN / ACCESSWIRE / June 1, 2020 / American Resources Corporation (NASDAQ:AREC) ('American Resources' or the 'Company'), a supplier of raw materials to the rapidly growing global infrastructure marketplace with a primary focus on the extraction, processing, transportation and distribution of metallurgical carbon to the steel and specialty metals industries, today reported its fourth quarter and full year ended December 31, 2019 financial results.

Mark Jensen, Chairman and CEO of American Resources Corporation commented, '2019 continued to be a transformational year for American Resources. Notwithstanding some industry headwinds in the latter half of the year, we achieved several important milestones. When reflecting on all of our achievements, we are extremely proud of our team for continuing to optimize our position within the metallurgical carbon market. Our mission continues to be a long-term and stable supplier of raw material to the global infrastructure market while bringing a more efficient and modernized business model to the industry. Additionally, as we execute on this mission, so does our equally important ability to provide stable long-term employment to a region in need.'

2019 Key Highlights

- February 2019: Successfully up-listed to the Nasdaq Capital Market under the ticker 'AREC,' providing shareholders with the fairest and most open marketplace as well increased visibility, recognition and value.

- October 2019: Announced the closing on the acquisition of Perry County Resources ('PCR'), the Company's eighth acquisition in five years. The addition of PCR to American Resources' platform further enhances the Company's position in the metallurgical carbon market by providing access to a well-known, high-quality product.

- Ongoing development achievements at the Company's McCoy Elkhorn complex to improve American Resources' long-term cost structure as well as disposing of non-core assets and environmental liabilities to improve its balance sheet.

Mark Jensen continued, 'Looking forward to the remainder of 2020 and into the coming years, we remain quite optimistic on global infrastructure demand and believe governments around the world will look to increase infrastructure projects as a way to stimulate economic activity as we come out of the COVID-19 pandemic. Given the immediate uncertainties regarding global end-markets and the competitive landscape, we are not providing any guidance at this time. However, we are very enthusiastic about our platform's position and our ability to be one of the largest growth pipelines at a time when so much supply has come offline.'

'Lastly, we have made significant steps to enhance our environmental, social and governance (ESG) profile. As previously stated, we expired our one and only thermal coal contract during the third quarter of 2019 to become a pure metallurgical carbon producer. Furthermore, we have advanced our environmental reclamation efforts to move over twelve thermal coal sites we assumed though our various acquisitions to ‘reclamation only' status, and have created partnerships to advance those projects past the environmental stage to create long-term economic and employment opportunities for local communities. We believe our ESG efforts will further distinguish American Resources as industry revolutionaries.'

Financial Results for Fourth Quarter and Year-End December 31, 2019

The Company reported net loss from operations of $59.9 million, or a loss of $2.94 per share for the year ended December 31, 2019, compared with a net loss from operations of $11.5 million, or a loss of $3.69 per share, for 2018. The Company earned adjusted earnings before interest, taxes, depreciation, amortization, accretion on asset retirement obligations, non-operating expenses, non-cash impairment and development costs (‘adjusted EBITDA') loss of $6.6 million for the year ended December 31, 2019, as compared with a loss of $3.35 million in 2018.

For the fourth quarter of 2019, American Resources reported a net loss from operations of $39.6 million, or a loss of $1.66 per share, as compared with a net loss from operations of $3.43 million, or a loss of $0.98 per share, in the prior-year period. The Company earned adjusted EBITDA loss of $3.1 million in the fourth quarter of 2019, as compared with adjusted EBITDA loss of $0.774 million for the fourth quarter of 2018.

Full Year 2019 Summary

Full year 2019 revenues were $24,477,707 compared to full year 2018 revenues of $31,524,825. The year-over-year decrease was mainly due to the Company's decision to expire its only thermal coal contract during the third quarter and shift away from the thermal coal market and purely focus on the global metallurgical carbon market. In conjunction with its focus on being a pure metallurgical carbon producer, the Company commenced its restructuring efforts of its recently acquired Perry County Resources complex in the fourth quarter of 2019. As such, PCR had not reached its maximum revenue and efficiency standards under its revised operating structure. Additionally, the Company incurred a non-cash impairment charge of $27,688,030 in the fourth quarter of 2019 due to the write-down of fixed assets and divestiture of certain surface and mineral acres located near Phelps, Kentucky that closed as of May, 2020.

2019 cost of sales (includes mining, transportation, and processing costs) were $26,086,814, compared to $24,992,312 during 2018. General and administrative expenses for the full year 2019 were $5,113,688, or 20.9 percent of total revenue. Depreciation was $4,588,136, or 18.7 percent of total revenue. American Resources incurred interest expense of $2,908,579 during 2019 compared to $1,288,991 during the full year of 2018. Development costs during the year were $7,236,652, compared to $3,815,235 in 2018.

The Company did not incur any income tax expense in 2019 as it was able to utilize its available net operating losses ('NOL') carried forward from prior periods of approximately $13,746,391 as of December 31, 2019.

Fourth Quarter 2019 Summary

Total revenues were $6,294,026 for the fourth quarter of 2019. Cost of sales (includes mining, transportation, royalty and processing costs,) for the fourth quarter of 2019 were $10.8 million, or 172 percent of total revenues, compared to $8.2 million, or 100 percent of total revenue in the same period of 2018.

General and administrative expenses for the fourth quarter of 2019 were $1,315,638, or 20.9 percent of total revenue, compared to $4,000,556 during the fourth quarter of 2018. Depreciation for the fourth quarter of 2019 was $1,551,389, or 24.7 percent of total revenue. American Resources incurred interest expense of $1,233,926 during the fourth quarter of 2019 compared to $424,886 during the fourth quarter of 2018. Development costs during the quarter were $1,324,063, compared to $1,425,024 in the third quarter of 2019.

Operational Results

The Company produced and sold 73,633 short tons of coal in the fourth quarter of 2019, compared to 25,969 short tons in the third of 2019 and 113,618 short tons in the fourth quarter of 2018. For the full year of 2019, the Company produced and sold 325,918 short tons compared to 435,574 short tons during 2018.

The exhibit below summarizes some of the key sales, production and financial metrics:

Notes:

(a) In short tons

(b) Excludes transportation

(c) Cash cost per ton is based on reported cost of sales and includes items such as production taxes, royalties, labor, fuel, and other similar production and sales cost items, and may be adjusted for other items that, pursuant to GAAP, are classified in the Statement of Operations as costs other than cost of sales, but relate directly to the cost incurred to produce coal. Our cash cost of sales per short ton is calculated as cash cost of sales divided by short tons sold, and our cash margin per ton is calculated by subtracting cash cost per ton from revenue per ton. Cash cost of sales per short ton and average cash margin per ton are non-GAAP financial measure which are calculated in conformity with U.S. GAAP and should be considered supplemental to, and not as a substitute or superior to financial measures calculated in conformity with GAAP. We believe cash cost of sales per ton and average cash margin per ton are useful measurse of performance as it aides some investors and analysts in comparing us against other companies. Cash cost of sales per ton and margin per ton may not be comparable to similarly titled measures used by other companies.

AMERICAN RESOURCES CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

AMERICAN RESOURCES CORPORATION

CONSOLIDATED BALANCE SHEETS

AMERICAN RESOURCES CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(1) Adjusted EBITDA is defined as net income before net interest expense, income tax expense, accretion expense, depreciation, non-cash stock compensation expense, transaction and other professional fees, and development costs. Adjusted EBITDA is not a measure of financial performance in accordance with GAAP, and we believe items excluded from Adjusted EBITDA are significant to a reader in understanding and assessing our financial condition. Therefore, Adjusted EBITDA should not be considered in isolation, nor as an alternative to net income, income from operations, cash flow from operations or as a measure of our profitability, liquidity, or performance under GAAP. We believe that Adjusted EBITDA presents a useful measure of our ability to incur and service debt based on ongoing operations. Furthermore, similar measures are used by analysts to evaluate our operating performance. Investors should be aware that our presentation of Adjusted EBITDA may not be comparable to similarly titled measures used by others.

Use of Non-GAAP Financial Measures

This release contains the use of certain U.S. non-GAAP financial measures. These non-GAAP financial measures are provided as supplemental information for financial measures prepared in accordance with GAAP. Management believes that these non-GAAP financial measures provide additional insight into the performance of the Company, and reflect how management analyzes Company performance and compares that performance against other companies. These non-GAAP financial measures may not be comparable to other similarly titled measures used by other entities.

About American Resources Corporation

American Resources Corporation is a supplier of high-quality raw materials to the rapidly growing global infrastructure market. The Company is focused on the extraction and processing of metallurgical carbon, an essential ingredient used in steelmaking. American Resources has a growing portfolio of operations located in the Central Appalachian basin of eastern Kentucky and southern West Virginia where premium quality metallurgical carbon deposits are concentrated.

American Resources has established a nimble, low-cost business model centered on growth, which provides a significant opportunity to scale its portfolio of assets to meet the growing global infrastructure market while also continuing to acquire operations and significantly reduce their legacy industry risks. Its streamlined and efficient operations are able to maximize margins while reducing costs. For more information visit americanresourcescorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

Special Note Regarding Forward-Looking Statements

This press release contains 'forward-looking statements' within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties, and other important factors that could cause the Company's actual results, performance, or achievements or industry results to differ materially from any future results, performance, or achievements expressed or implied by these forward-looking statements. These statements are subject to a number of risks and uncertainties, many of which are beyond American Resources Corporation's control. The words 'believes', 'may', 'will', 'should', 'would', 'could', 'continue', 'seeks', 'anticipates', 'plans', 'expects', 'intends', 'estimates', or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Any forward-looking statements included in this press release are made only as of the date of this release. The Company does not undertake any obligation to update or supplement any forward-looking statements to reflect subsequent events or circumstances. The Company cannot assure you that the projected results or events will be achieved.

PR Contact:

Precision Public Relations

Matt Sheldon

917-280-7329

[email protected]

Investor Contact:

JTC Team, LLC

Jenene Thomas

833-475-8247

[email protected]

Company Contact:

Mark LaVerghetta

317-855-9926 ext. 0

Vice President of Corporate Finance and Communications

[email protected]

SOURCE: American Resources Corporation

View source version on accesswire.com:

https://www.accesswire.com/592175/American-Resources-Corporation-Reports-Fourth-Quarter-and-Full-Year-2019-Financial-Results-and-Provides-Business-Outlook

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Baltimore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Baltimore Star.

More InformationBusiness

SectionBitcoin soars to a record on Trump policies, institutional demand

NEW YORK CITY, New York: Bitcoin surged to a new all-time high this week, buoyed by growing institutional interest and a wave of pro-crypto...

Huawei eyes new buyers for AI chips amid U.S. export curbs

SHENZHEN, China: As global chip competition intensifies, Huawei Technologies is exploring new markets in the Middle East and Southeast...

U.S. food prices at risk as Brazil tariff hits key imports

LONDON/NEW YORK CITY: American grocery bills may be headed higher as coffee and orange juice prices face upward pressure from new tariffs...

WK Kellogg sold to Ferrero as food giants chase shelf power

BATTLE CREEK, Michigan: In a major consolidation of iconic food brands, WK Kellogg has agreed to be acquired by the owner of Ferrero...

Filmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

Business

SectionBitcoin soars to a record on Trump policies, institutional demand

NEW YORK CITY, New York: Bitcoin surged to a new all-time high this week, buoyed by growing institutional interest and a wave of pro-crypto...

Huawei eyes new buyers for AI chips amid U.S. export curbs

SHENZHEN, China: As global chip competition intensifies, Huawei Technologies is exploring new markets in the Middle East and Southeast...

U.S. food prices at risk as Brazil tariff hits key imports

LONDON/NEW YORK CITY: American grocery bills may be headed higher as coffee and orange juice prices face upward pressure from new tariffs...

WK Kellogg sold to Ferrero as food giants chase shelf power

BATTLE CREEK, Michigan: In a major consolidation of iconic food brands, WK Kellogg has agreed to be acquired by the owner of Ferrero...

Filmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...